Key Insights compared to the average Canadian

Young adults under 30 exhibit distinctive automotive behaviors that set them apart from the average Canadian driver.

Vehicle Ownership

- No vehicles: 20% of young adults do not own any vehicles, making them 22% more likely than the average to be vehicle-free.

- Single Vehicle Ownership: They are 15% less likely to own just one vehicle compared to other age groups.

- Multiple vehicles: 8% own more than three vehicles, a rate 30% higher than the national average.

Preferences and Priorities

- Purchase Model Year: Young adults have a strong preference for European premium (luxury) vehicles that are within 1-2 years old. This reflects their desire for the latest technology and features such as Bluetooth and smartphone integration.

- Vehicle Cost: Cars favored by this group are more likely to cost $75K or more, indicating a willingness to invest in luxury and prestige.

- Leasing Preferences: Leasing is highly preferred for both new and used vehicles, which contributes to lower maintenance costs and provides flexibility in vehicle upgrades.

- Car Features: The looks, prestige, and status of the car are major influences on purchasing decisions.

- Electric Vehicles: Young adults are 20% more likely to want an electric car, aligning with environmental concerns and technological advancement.

Driving and Maintenance Behavior

- Driving Behavior: This age group exhibits more risk-taking behavior, with less insurance coverage and a preference for driving fast. They also drive fewer kilometers annually than average Canadians.

- Maintenance and Services: This group tends to avoid dealership services, possibly due to cost concerns or a desire for more personalized service options.

Summary: Young adults under 30 show a clear preference for newer, more luxurious vehicles driven by a desire for status and the latest technology. Their lower vehicle ownership rates may be linked to urban lifestyles and financial constraints, but when they do own cars, they lean towards high-cost, high-prestige models. Their inclination to lease and avoid dealership services indicates a focus on convenience and maintaining a modern image, even if it means taking on more financial risk.

Where they are Located Around Toronto

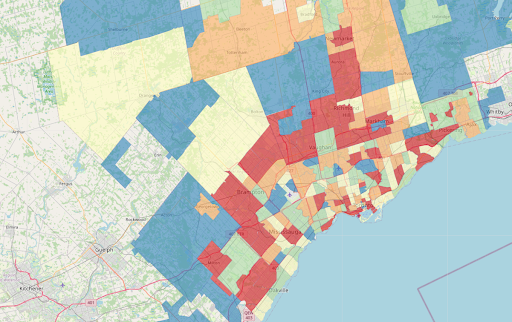

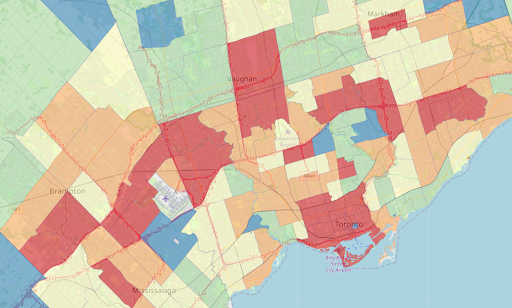

Photo above shows young adults aged 20-30 with 3+ vehicles in suburban areas. High concentration is shown using red.

Suburban and Urban Vehicle Ownership Trends

Suburban areas: Markham, Richmond Hill, Aurora, Milton, Pickering and Oakville

Young adults aged 20-30 who own 3 or more cars show a unique pattern of vehicle ownership influenced by several factors:

- Suburban Lifestyle: In these suburban area, the limited transit options make owning multiple vehicles necessary for commuting, family use, and personal convenience.

- Higher Household Incomes: These regions generally have higher household incomes, allowing young adults to afford multiple vehicles, especially in households with more than one working individual.

- Larger Properties: Homes in these areas often come with more space, including larger driveways or garages, making it feasible to own and park multiple cars.

- Family-Oriented Communities: Many young adults still live with parents in these suburbs, leading to the need for additional vehicles for different family members or specific purposes (e.g., a family car, a work vehicle, and a personal vehicle).

- Car Culture: Owning multiple vehicles may be seen as a status symbol or is simply more common due to lifestyle preferences.

In contrast, young adults aged 20-30 in urban cities do not own vehicles and can be attributed to several factors:

- Public Transit Accessibility: These areas have well-developed public transit systems, making it easier and more convenient for young adults to rely on public transportation instead of owning a car.

- Urban Lifestyle: Downtown areas like Toronto offer a dense, walkable environment with amenities, work opportunities, and entertainment within close proximity, reducing the need for a personal vehicle.

- Cost of Vehicle Ownership: The cost of owning and maintaining a vehicle, including parking fees, insurance, and fuel, can be prohibitive for younger individuals, especially in expensive urban areas.

- Environmental Concerns: Many young people are increasingly conscious of their environmental impact and may choose to use public transit, bike, or walk as more sustainable options.

- Shift Toward Shared Mobility: The availability of ride-sharing services like Uber and Lyft, as well as car-sharing programs, provides flexible alternatives to owning a car.

Sources of Information and Their Influence:

Greatly Influenced By:

- Radio Programs: Despite being a digital-savvy group, radio still plays a significant role, possibly during commutes or leisure time.

- Social Media: Social media platforms like Instagram and TikTok are powerful tools for reaching young adults, especially when combined with engaging content.

- Influencers and Celebrities: Endorsements by trusted influencers or celebrities can significantly sway opinions, particularly when these figures are seen as relatable or aspirational.

- Podcasts: As an increasingly popular medium, podcasts allow in-depth discussions on automotive topics, which resonate well with this demographic.

Slightly Influenced By:

- Friends and Family: Personal recommendations still hold some sway in this age group, reflecting the importance of peer influence.

- Online Videos: Platforms like YouTube are popular, where video content, including reviews and demonstrations, can impact their purchasing decisions.

- Digital Newspapers and Magazines: Online articles provide detailed information, particularly about the latest car models and trends.

- TV Programs: While traditional TV is less popular, specific car-related shows or segments can capture attention.

- Auto Blogs and Auto Shows/Events: Specialized content is valuable for those deeply interested in cars.

- Out-of-Home Advertisements: This includes ads seen in public spaces like subways, streets, and elevators, which can catch the eye during their daily routines.

Very Unlikely to be Influenced By:

- Flyers Delivered to Door: This traditional method is largely ignored by this tech-oriented group.

- Dealership and Manufacturer Marketing Material: Direct marketing from dealerships or manufacturers is often viewed skeptically or as overly promotional.

- Consumer Guides: Despite being thorough, these are not the go-to source for young adults, who prefer more dynamic and easily digestible content.

- Physical Newspapers: With a preference for digital consumption, print media is largely out of favor.

Insights from Manifold’s Data

Our data indicates that young adults are more likely to be influenced by dynamic, interactive, and engaging forms of media, such as social media and influencer content. This preference aligns with their desire for the latest technology and trends, as seen in their vehicle choices and leasing behaviors. Interestingly, although they try to avoid social media ads, TV ads are less frequently bypassed, suggesting a unique opportunity for brands to craft compelling television campaigns targeted at this group. Marketers can use this insight to influence those without a car or encourage trade ins or future purchases for those with many.

Implications for Automotive Marketing:

- Strategic Focus on Social Media and Influencers: Given the strong influence of social media and influencers, automotive brands should invest in targeted campaigns on platforms like Instagram, TikTok, and YouTube. Collaborations with influencers who resonate with young adults can effectively highlight the tech-savvy features and prestige associated with luxury car models.

- Leverage Radio and Podcasts: Integrating automotive ads into popular radio programs and podcasts can reach young adults during commutes or other activities, reinforcing brand messages in a less intrusive manner.

- Selective Use of TV Advertising: While traditional TV advertising is less prevalent, strategically placed ads in relevant TV programs or during peak viewing times can capture this segment’s attention, particularly if the content resonates with their lifestyle and aspirations.

- Avoid Traditional Print and Direct Mail: The data suggests that traditional print media and direct mail are ineffective for this demographic. Brands should instead focus on digital and experiential marketing efforts that offer more engaging and personalized experiences.

By understanding and leveraging these media consumption habits, automotive companies can better position themselves in the market, tailoring their strategies to meet the specific preferences and behaviors of young adults. This approach not only enhances the effectiveness of marketing campaigns but also fosters a deeper connection with a segment that values innovation, status, and convenience.

At Manifold, our data-driven insights help businesses like yours craft targeted and impactful marketing strategies. If you’re looking to connect with detailed consumer segment data in any industry, consider leveraging our expertise to maximize your reach and influence. Contact us today to learn how we can support your marketing goals.