Based on Census 2021, our adjustments for undercount and other items, we estimate that there will be around 15.8 million households in Canada for the year 2023. 10.8 million of these households are homeowners, and 6.5 million of these homeowners have mortgages on their homes. The average outstanding mortgage value is about $242,000.

Historical trends show that approximately 10% of households shop for mortgages every year. Trends also show there will be around 650,000 home buyers this year. In other words, 1.58 million Canadian households will be shopping or negotiating for a mortgage this year.

Several distinct factors related to mortgage shoppers include:

- The rapid growth of the immigrant population

- The expansion of new condominiums and residential areas

- The drastic increase in home prices and real estate market activity

- The rising rate of inflation

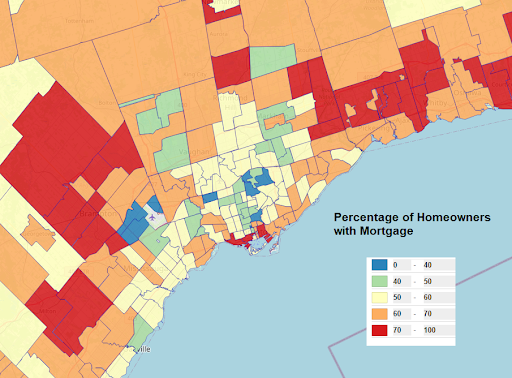

All of these have a significant impact on mortgage buyer behaviour. For example, over 70% of homeowners in Toronto’s downtown, east end, and north west have mortgages. Consequently, these areas have more households shopping for mortgages this year than other areas.

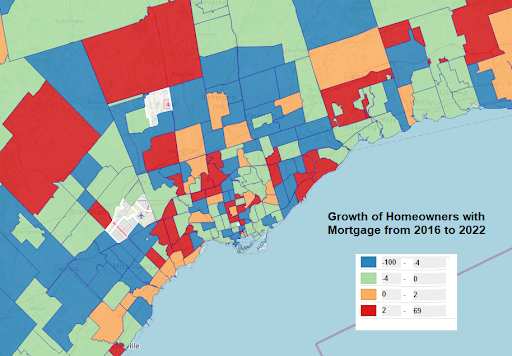

On the other hand, thanks to the steady economic situation and aging population, many homeowners paid off their mortgage from 2016 to 2022. For example, the following map shows that, in fact, the percentage of homeowners with mortgages decreased in most areas in Toronto CMA during this period. Therefore, targeting people who will be shopping for mortgages will need to be a very selective process. That is why Manifold’s granular and comprehensive data products offer powerful insights for finding best prospects.

The vast majority of households spend the largest portion of their income on housing costs which include:

- Shelter

- Mortgage payments, property taxes and condominium fees

- Maintenance, repairs and replacements

- Utility costs (e.g., electricity, heating, and water)

- Other municipal services

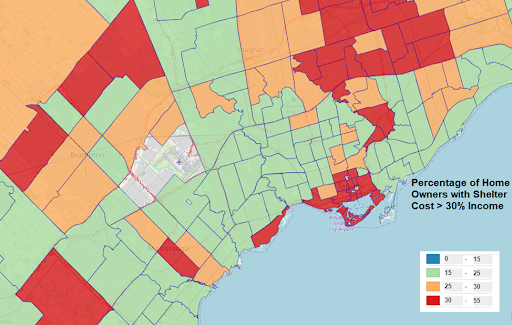

The rapid rise in home prices has been posing challenges to many households since 2016. As a general rule, households are considered to have affordability problems if more than 30% of their income is spent on housing costs. Once shelter costs exceed 30% of their income, it is likely that there will be insufficient funds for other necessities such as food, clothing, and transportation. These households will be sensitive to changes in their mortgage rates. The map below illustrates hot spots in Toronto where homeowners’ shelter costs exceed 30% of their income in 2021.

Contact Info:

For more information, please do not hesitate to contact us:

Dr. Zhen Mei

Manifold Data Mining Inc.

220 Duncan Mill Road, Suite 519

Toronto, ON M3B 3J5

Canada

T: 416-760-8828