The COVID-19 pandemic has rattled many Canadians’ lives over the last two years. It impacted how we work, socialise and spend. We saw changes in our daily lives, from impulse purchases of toilet paper to an uptick of engagement in outdoor activities. Now thanks to vaccinations and re-openings, we have been returning to pre-pandemic activities such as in-person shopping, travelling abroad, and dining out. While some of our daily habits are returning to normal, other habits we picked up over the pandemic such as increased online shopping will probably never return to pre-COVID levels. We got used to the convenience of online shopping, and some of us may replace this with going to physical store locations permanently. This may be the case especially for seniors and immunocompromised people who benefit from the convenience, the minimised contact, and lower risk that online shopping provides.

Our lives have changed drastically in the past two years. We can see many of those changes in our lifestyles and consumer behaviour through Manifold’s modelled, annually updated data. To track some of these changes, each year of data may be roughly connected to different stages of the pandemic:

- 2019 represents pre-COVID, at this time there were no signs of coronavirus infection in Canada.

- 2020 covers the beginning of the COVID pandemic. This year had several lockdowns with peak travel, social, and masking restrictions.

- In 2021 COVID recovery began, and most restrictions were lifted, so this year may be interpreted as the start of a new normal.

In this blog post, we use our data to uncover some major changes we see in food consumption, cleaning product usage, online shopping, travel, and restaurant visitation over these transitional years (2019-2021).

Food Consumption

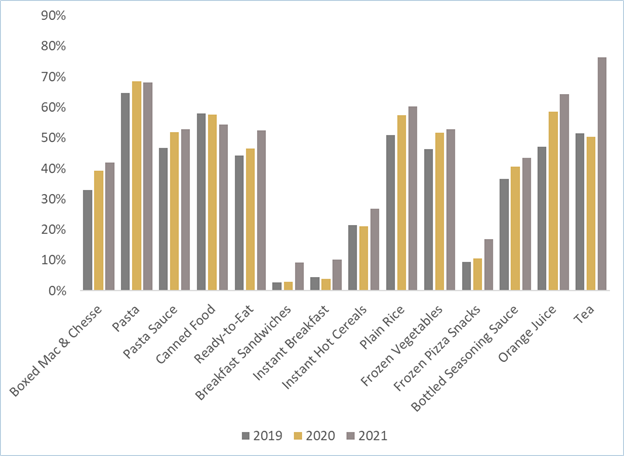

At the beginning of the pandemic, fear of scarcity struck many Canadians. People began buying food and grocery items in bulk and stockpiling in preparation for a lockdown. Our data shows that consumption of canned, ready-to-eat, and dry foods such as boxed dried Mac & Cheese, pasta and instant cereals increased by 6%, 8% and 9%, respectively, in 2020 and 2021 (Figure 1). We see large spikes in orange juice and tea consumption, up by 17% and 25%. (Figure 1). Perhaps people are drinking more tea because they want to avoid health problems and tea is known to boost your immune system.

Figure 1: Foods consumed in the past month

Household Products

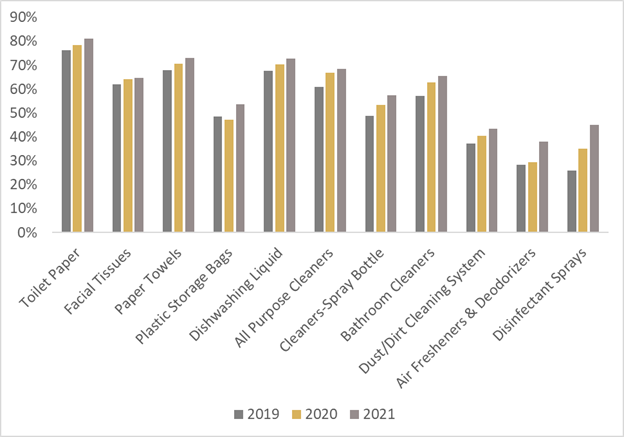

We see a similar trend for household product consumption. More people are using disinfectant sprays, household cleaners, and paper towels post COVID (2021) in comparison to pre COVID (2019). This increase in consumption of dry foods and of household products likely represents the proportion of households that chose to purchase more storable products they deemed necessary. Since the majority of companies adopted a work-from-home model, it may also be that these increases are a result of more time spent at home where consumers are using up their household items more quickly.

Figure 2: Household products used in the past 30 days

Travel Activities

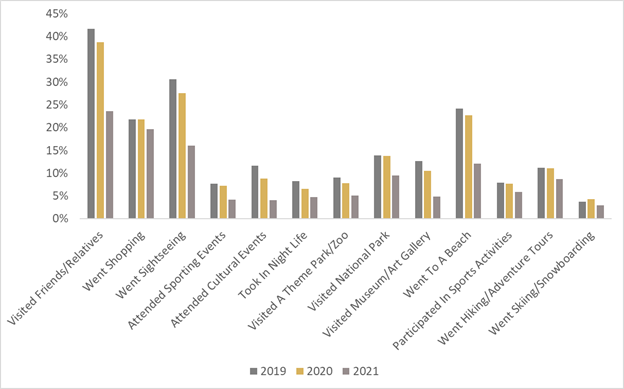

As borders closed and travel restrictions were implemented, people found it increasingly difficult to see their families and friends. Due to lockdowns and quarantine, more people stayed at home to avoid contact with others. There was a decrease in almost all travel activities over the pandemic (Figure 3). Local activities such visiting national parks and outdoor sports activities were more frequently preferred because they were safer.

Figure 3: Travel Activities Done in Past 12 month

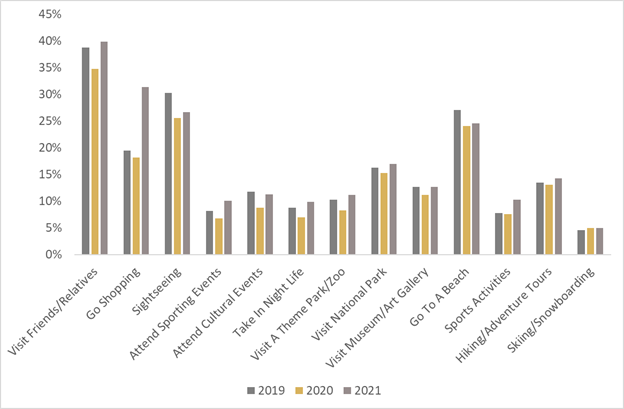

Although travel activities declined across the board over the pandemic (Figure 3), there is all pent up demand for travel which is reflected in the public’s increased intention to travel (Figure 4). People are hoping to return to activities such as in-person shopping, hiking and cultural events in the coming years and have already started to do so. Some trends we are seeing in 2022 for travel is that because people are now able to travel with fewer restrictions, travel spending is up 30% compared with this time last year. Cruise ship bookings are back to 2019 numbers. Royal Caribbean reported exceeding 2019 booking volumes, even in Europe.

Figure 4: Travel Activities – Intend to Do in Next 12 Months

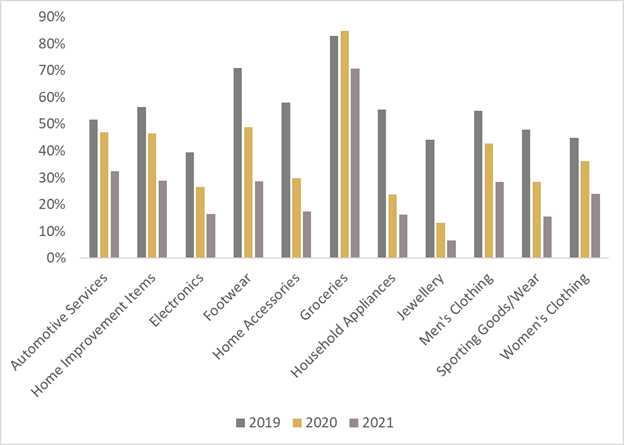

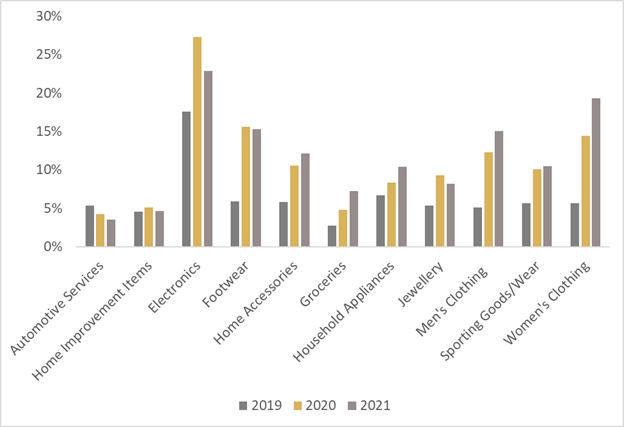

Shopping

As a result of the lockdowns, as well as personal efforts to minimise contact, consumers could not resist the convenience and safety that online shopping offered them. Less consumers chose to shop at physical store locations while more consumers began choosing online shopping (Figure 5 and 6). For example, online grocery shopping and clothing purchases increased while these purchases decreased in physical store locations.

Figure 5: Categories Shopped Most Often In-store

Figure 6: Categories Shopped Most Often Online

Restaurants

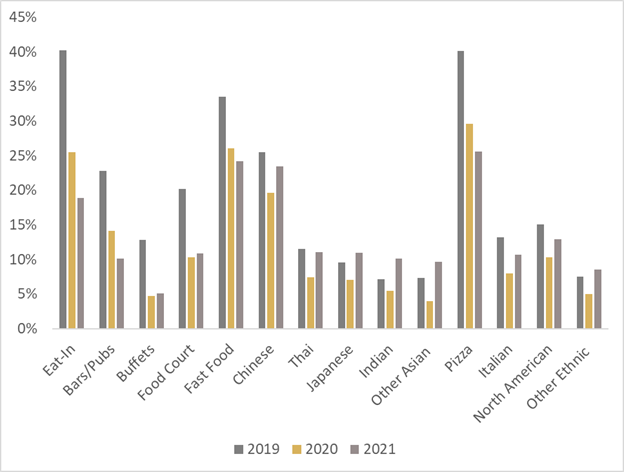

When the pandemic first broke out, customers avoided dining at restaurants both due to restrictions and their want to minimise risk. Even though restaurants began to open in 2020, people were cautious, and regulations remained in place.

As restaurants begin to recover, we can see there is a growing preference for ethnic restaurants such as Indian and Japanese cuisine (Figure 7). People are looking for more diverse food experiences, creating opportunities for ethnic cuisine to flourish.

Figure 7: Restaurants visited in past 30 days

Nowadays, people are dining out and travelling more and more, but the new issue is one of supply. There is a labour shortage as well as increased food and rent prices which make it difficult to meet the increased demand.

Overall, here are a few of the key changes in consumer behaviour over the pandemic years!

Through our data we saw that over the pandemic, Canadians chose to:

- Purchase more storable items, such as dry foods and toilet paper.

- Travel less due to travel restrictions and limitations.

- Shop more online and less in-store as a result of lockdowns and mandates.

- Visit restaurants less frequently due to operation restrictions and social distancing.

We model over 30,000 current year variables, so in terms of COVID related changes that our data can capture, this post just scratches the surface!

Will These Changes in Consumer Behaviour Stick Around?

Product Consumption

As recovery continues, it is hard to say whether individuals will continue to increase their purchases of storable food and cleaning products. We expect that for food items, this will level off. However, as more people adopt a hybrid work schedule (part at home part at work), we may see the consumption decline simply because they spend less time at home.

Travel

Despite increased travel intent, we anticipate a slow long term recovery process for international travel. Inflation and rising prices are two of the most pressing issues confronting individuals today. The rise in travel-related costs, such as airline airfares and lodging expenses, may discourage people from travelling in the coming months.

That said, we’ve already seen travel spending begin to increase this year (highlighted earlier in the post). Why is that? Our research and analysis shows that households in the top income quintile (i.e. top 20%) saved an extra $35,000 more in 2020 than they did pre-COVID! In 2021, the top income quintile saved an extra $20,000 more than they did pre-COVID.

There is all this pent up travel demand and households with larger than usual savings that are behind the increased spending on categories they were not able to spend on during COVID, i.e. travel, restaurants, and a few others.

Restaurant Visitation

Restaurants have been among the most resilient industries in the face of the pandemic, surviving through innovation and the adoption of new technologies. With growing vaccination rates and enhanced health measures, we expect indoor and in-person dining at restaurants to bounce back. People may feel more at ease eating out now that restrictions have been lifted and a greater number of restaurants have opened.

Online vs. In Person Shopping

Given how quick technology is evolving, we believe that more consumers will choose to shop online in the future. We expect e-commerce sales to rise as more people recognize the convenience of online stores and the benefits of personalised recommendations. This is simply because consumers are no longer restricted to brick and mortar stores, but instead have a variety of options at their disposal.

Want to know more about lifestyle choices and the effects of COVID-19?

Contact us to learn more!

Sources