Grocery costs have been rising since 2021, with consumer inflation raising concerns among Canadians about their day to day expenses. While food inflation has eased slightly in recent months, many grocery items are still about 20% more expensive than they were two years ago. In this blog, we will explore the reasons behind the increase in grocery prices and how Canadian households are adjusting their purchasing habits to navigate this challenging economic landscape.

Factors contributing to the steady rise in food prices include:

- Post-lockdown economic recovery

- Elevated costs of materials and transportation

- Poor and unfavourable growing conditions

- Disruptions in the supply chain

- Increasing profit margins for wholesalers and retailers

How are Canadians responding to higher food costs?

A survey conducted by Statistics Canada highlighted that rising prices have become a significant concern for many Canadians, with food costs especially worrisome. As everyday expenses become harder to afford and manage, the rise of grocery prices had a greater impact than that of other costs like housing and transportation.

In order to navigate the rising grocery prices, many Canadian households are actively looking for ways to adapt by:

- Adjusting purchasing habits

- Changing food consumption patterns

- Shifting towards discount grocers and general merchandise stores

Adjusting purchasing habits

To cope with the rising grocery prices, many Canadians are adjusting their grocery shopping habits. In the Statistics Canada survey, one-third of respondents revealed that they actively seek out sales or promotions to save money. Others are opting for cheaper alternatives such as less expensive brands or items to counter the price pressures. A recent survey by Capterra found that 86% of Canadians have changed their spending habits, with 71% saying they are either purchasing or using fewer grocery store items than before. Many consumers are now turning to private label brands for both fresh and packaged goods, and brand and store switching has become prevalent.

Manifold data shows that in 2021, when compared to 2019, there was a noticeable increase in grocery consumption for non-branded or store brands such as President’s Choice, Compliments, Selection, and similar brands. Over the same period, there was also a 20% increase in the use of any grocery store coupons.

Changing food consumption patterns

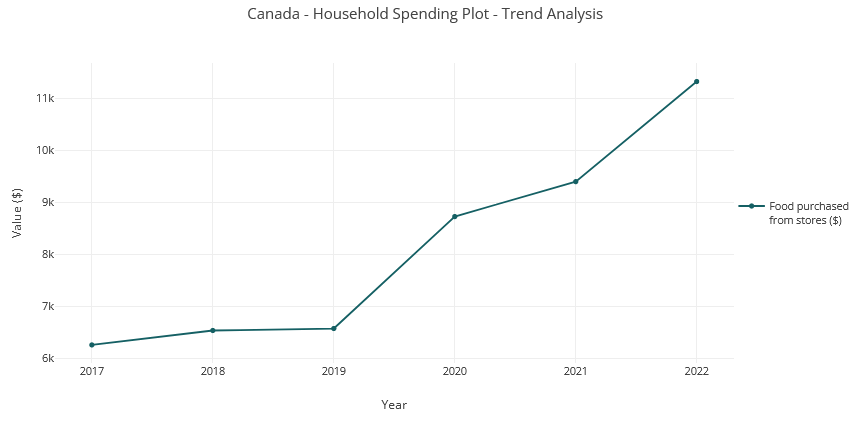

Household spending data shows that during the earlier months of the COVID-19 pandemic, there was a surge in the volume of food purchased by households, reaching nearly 15% above pre-pandemic levels in early 2021. However, as COVID-19 restrictions eased and consumers resumed spending on dining out and out-of-home services, household food volumes saw a decline, although still remaining 1.1% higher than pre-pandemic levels as of early 2023.

During the pandemic, there was also a notable rise in the consumption of dried and frozen foods. Manifold’s data illustrates that in 2020, the consumption for dried pasta saw a significant 16% increase. A similar trend was observed for canned foods, with canned vegetables and fish/seafood experiencing a 5% rise in consumption.

Shifting towards Discount Grocers and General Merchandise Stores

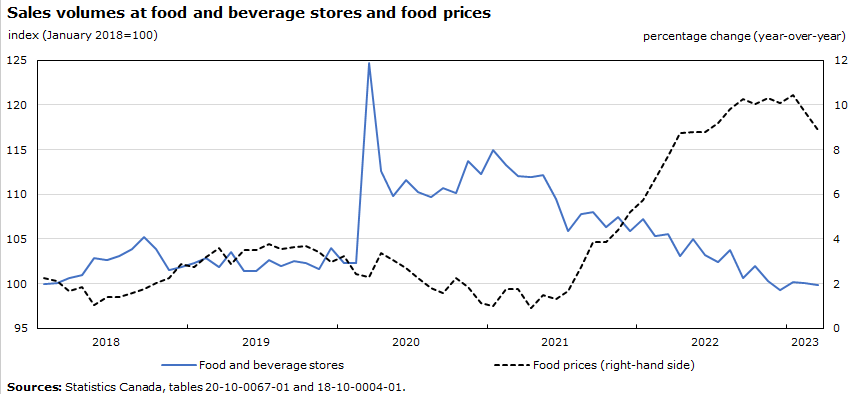

In response to the escalating grocery prices, consumers have moved away from food and beverage stores and gravitating towards stores such as warehouse clubs, supercentres, and other general merchandise retailers. Prior to the pandemic, food and beverage store sales accounted for 73% of all retail food purchases. However, with the price surge, food and beverage stores’ proportion of retail food sales began to shrink, eventually falling to 70% in late 2022. Simultaneously, the share of food sales in general merchandise stores has increased, surging from 21.6% in early 2021 to 25.9% in late 2022.

Manifold data shows that in 2021, more affordable grocery stores such as FreshCo, No-frills and Food Basics experienced a boost in retail sales in their stores. No Frills’ sales increased by 5%, Food Basics by 4% and FreshCo by 2.5%. This is a big difference considering that stores like Whole Foods saw a declining trend.

This shift in retail preferences, in combination with the rising grocery prices, is evident in the retail sales data from food and beverage stores. Since the beginning of the price surge, sales at these stores have trended downward, indicating that consumers are spending more money but purchasing fewer items. While current sales in dollars at these stores have grown by 5.8%, sales measured in terms of volume have declined by 3.5%.

All in all, the rise in grocery prices has affected Canadian households’ ability to manage their daily expenses. People are changing their buying habits in response to rising costs, looking for bargains and less expensive alternatives. Additionally, the shift towards discount grocers and general merchandise stores reflects a shift in the consumer environment as a result of food inflation. Canadians should be aware of these trends in order to better navigate the effects of rising grocery prices. Finding ways to make essential food items more affordable will be crucial for the well-being of Canadian households.

Want to know more about changes in consumption patterns and the impacts of COVID-19?

Check out our blog post on “How Has COVID-19 Affected Your Lifestyle?” or contact us to learn more!